Vermont Non Resident Withholding Tax . the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. learn how to withhold vermont income tax from wages, pensions, annuities, and other payments. in vermont, sellers of real property who are not residents of the state are subject to a real estate withholding tax, collected at the time. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. Find out the filing status, number of allowances, and extra withholding for.

from www.formsbank.com

learn how to withhold vermont income tax from wages, pensions, annuities, and other payments. in vermont, sellers of real property who are not residents of the state are subject to a real estate withholding tax, collected at the time. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. Find out the filing status, number of allowances, and extra withholding for. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a.

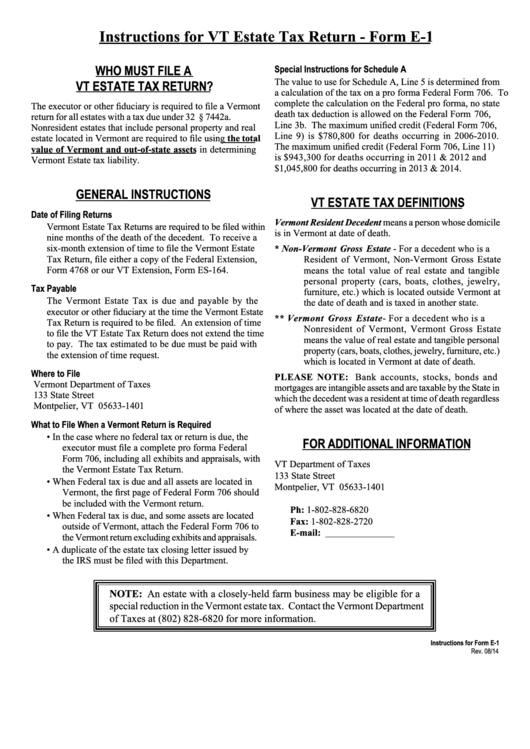

Fillable Vt Form E1 Estate Tax Return Resident And Nonresident

Vermont Non Resident Withholding Tax Find out the filing status, number of allowances, and extra withholding for. in vermont, sellers of real property who are not residents of the state are subject to a real estate withholding tax, collected at the time. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. learn how to withhold vermont income tax from wages, pensions, annuities, and other payments. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. Find out the filing status, number of allowances, and extra withholding for.

From www.templateroller.com

Form RCC146 Download Fillable PDF or Fill Online Vermont Renter Credit Vermont Non Resident Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. Find out the filing status, number of allowances, and extra withholding for. . Vermont Non Resident Withholding Tax.

From www.templateroller.com

Vermont Nonresident Permit Application to Take Black Bear With Dogs Vermont Non Resident Withholding Tax Find out the filing status, number of allowances, and extra withholding for. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. in vermont, sellers of real property who are not residents of the state are subject to a real estate withholding tax,. Vermont Non Resident Withholding Tax.

From www.pdffiller.com

2021 Form VT HS122 & HI144 Fill Online, Printable, Fillable, Blank Vermont Non Resident Withholding Tax the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. Find out the filing status, number of allowances, and extra withholding for. . Vermont Non Resident Withholding Tax.

From www.templateroller.com

VT Form IN111 2018 Fill Out, Sign Online and Download Fillable PDF Vermont Non Resident Withholding Tax Find out the filing status, number of allowances, and extra withholding for. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in. Vermont Non Resident Withholding Tax.

From www.templateroller.com

VT Form WHT430 Download Fillable PDF or Fill Online Withholding Tax Vermont Non Resident Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. Find out the filing status, number of allowances, and extra withholding for. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. . Vermont Non Resident Withholding Tax.

From www.templateroller.com

Download Instructions for VT Form LGT177 Vermont Land Gains Vermont Non Resident Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. in vermont, sellers of real property who are. Vermont Non Resident Withholding Tax.

From www.templateroller.com

VT Form WH435 Download Fillable PDF or Fill Online Estimated Vermont Non Resident Withholding Tax learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. in vermont, sellers of real property who are. Vermont Non Resident Withholding Tax.

From www.formsbank.com

Fillable State Of Vermont Department Of Taxes Vermont Employee'S Vermont Non Resident Withholding Tax Find out the filing status, number of allowances, and extra withholding for. in vermont, sellers of real property who are not residents of the state are subject to a real estate withholding tax, collected at the time. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for.. Vermont Non Resident Withholding Tax.

From www.propertyrebate.net

Form Rew 1 Vermont Withholding Tax Return For Transfer Of Real Vermont Non Resident Withholding Tax learn how to withhold vermont income tax from wages, pensions, annuities, and other payments. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. the vermont department of taxes has issued guidance on its website stating that employers are not required to. Vermont Non Resident Withholding Tax.

From www.templateroller.com

VT Form LGT177 Fill Out, Sign Online and Download Fillable PDF Vermont Non Resident Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. learn how to withhold vermont income tax from wages, pensions, annuities, and other payments. learn how to calculate your vermont income tax return if you were not a resident of vermont during the. Vermont Non Resident Withholding Tax.

From www.peetlaw.com

Vermont NonResident Withholding Tax Vermont Non Resident Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. Find out the filing status, number of allowances, and extra withholding for. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. . Vermont Non Resident Withholding Tax.

From www.formsbank.com

Fillable Vt Form E1 Estate Tax Return Resident And Nonresident Vermont Non Resident Withholding Tax the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. in vermont, sellers of real property who are not residents of the. Vermont Non Resident Withholding Tax.

From www.templateroller.com

VT Form WHT430 Fill Out, Sign Online and Download Fillable PDF Vermont Non Resident Withholding Tax (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in vermont by a. Find out the filing status, number of allowances, and extra withholding for. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. . Vermont Non Resident Withholding Tax.

From www.pdffiller.com

Fillable Online state vt Vermont withholding tax return for transfer of Vermont Non Resident Withholding Tax learn how to withhold vermont income tax from wages, pensions, annuities, and other payments. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. Find out the filing status, number of allowances, and extra withholding for. (a) except as otherwise provided in. Vermont Non Resident Withholding Tax.

From medium.com

Vermont Work Taxes for NonResidents Zrivo Medium Vermont Non Resident Withholding Tax learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. (a) except as otherwise provided in this section, in the case. Vermont Non Resident Withholding Tax.

From www.formsbank.com

Form Wh435 Vermont Estimated Tax Payments For Nonresident Vermont Non Resident Withholding Tax Find out the filing status, number of allowances, and extra withholding for. learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. in vermont, sellers of real property who are not residents of the state are subject to a real estate withholding tax,. Vermont Non Resident Withholding Tax.

From www.templateroller.com

Form 70000209 Download Fillable PDF or Fill Online Petition for Non Vermont Non Resident Withholding Tax in vermont, sellers of real property who are not residents of the state are subject to a real estate withholding tax, collected at the time. the vermont department of taxes has issued guidance on its website stating that employers are not required to begin withholding for. (a) except as otherwise provided in this section, in the case. Vermont Non Resident Withholding Tax.

From www.templateroller.com

VT Form RW171 Fill Out, Sign Online and Download Fillable PDF Vermont Non Resident Withholding Tax learn how to calculate your vermont income tax return if you were not a resident of vermont during the tax year but earned income in. Find out the filing status, number of allowances, and extra withholding for. (a) except as otherwise provided in this section, in the case of any sale or exchange of real property located in. Vermont Non Resident Withholding Tax.